Addressing Concerns About Fixed Income Markets

MODERNIST’S ASSET CLASS INVESTING PORTFOLIOS ARE STRATEGICALLY INVESTED WITH A FOCUS ON LONG-TERM PERFORMANCE OBJECTIVES. PORTFOLIO ALLOCATIONS AND INVESTMENTS ARE NOT ADJUSTED IN RESPONSE TO MARKET NEWS OR ECONOMIC EVENTS; HOWEVER, OUR INVESTMENT COMMITTEE EVALUATES AND REPORTS ON MARKET AND ECONOMIC CONDITIONS TO PROVIDE OUR INVESTORS WITH PERSPECTIVE AND TO PUT PORTFOLIO PERFORMANCE IN PROPER CONTEXT.

You've likely heard about recent news of rising interest rates and the impact they're having on our dear friends, bonds (aka fixed income). This article from our Investment Committee gets into all the nitty gritty details, so read on fellow finance geeks!

Last week’s extraordinary 75 basis point rate hike from the Federal Reserve was the latest development in a challenging 2022 for fixed income markets. Through June 15, the broad U.S. fixed income market was down 11.7% as measured by the Bloomberg U.S. Aggregate Bond Index, while U.S. Treasuries posted a loss of 9.5% as measured by the Bloomberg U.S. Treasury 3-10 Year Bond Index. Naturally, this has caused a good deal of concern among fixed income investors. In this piece, we will address these investor concerns and answer many of the common questions we are receiving about fixed income markets.

Why have we seen such poor performance from fixed income?

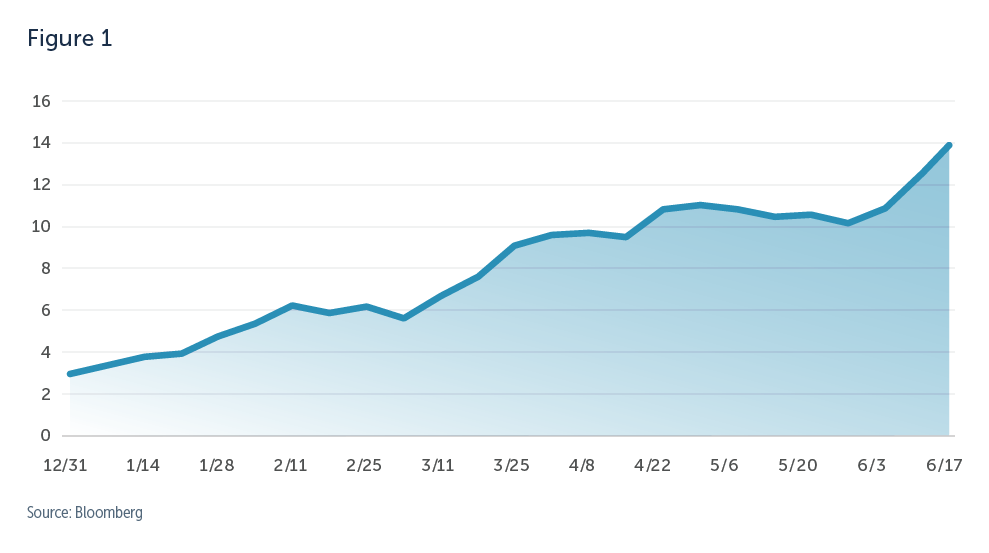

The poor performance has been driven by a significant increase in rates due to the Fed’s policy toward reducing inflation, or rather expectations for the Fed’s response to inflation. At the beginning of 2022, the Fed had signaled it would likely raise the federal funds target rate three times over the course of the year to combat inflation. As 2022 progressed and the Fed realized inflation continued to trend higher--and was not simply “temporarily” high--the market began to alter its expectation for the path of the target rate. Fed Funds Futures demonstrate how expectations have shifted.

Figure 1 shows the number of expected 25 basis point hikes in the target rate for 2022.

The dramatic change in expectations for the speed and overall increase in the target rate naturally pushed up other fixed income rates, like Treasury yields, in tandem. Figure 2 shows the increase in Treasury yields month over month, which has resulted in the historically poor fixed income performance through June 14.

How have Buckingham’s fixed income portfolios fared relative to the broader fixed income markets?

Buckingham’s fixed income strategy has always focused on high-quality issuers with short-to intermediate-term maturities. This focus on shorter maturities relative to the market serves to lower portfolio volatility while also still capturing a healthy portion of the yield within the curve. This philosophy has served our clients well during this period of heightened volatility as our portfolios have, in general, fared better than the broad market. As mentioned above, the broad U.S. fixed income market was down 11.7% as measured by the Bloomberg U.S. Aggregate Bond Index. In comparison, the fixed income portion of our client portfolios, in general, did not experience such dramatic underperformance because bonds with shorter maturities have performed better than their longer-maturity counterparts.

What are interest rates and inflation expected to do moving forward?

Today’s yield curve can tell us a great deal about what the market is expecting rates and inflation to do in the future. Using current yields, Buckingham’s Fixed Income Team can compute a forward rate curve that helps better understand the market’s expectations of future interest rates.

Figure 3 shows today’s Treasury curve versus the one-year forward rate curve. As you can see, the market is pricing in significant rate increases in the one- to three-year portion of the curve, with more modest increases further out on the curve.

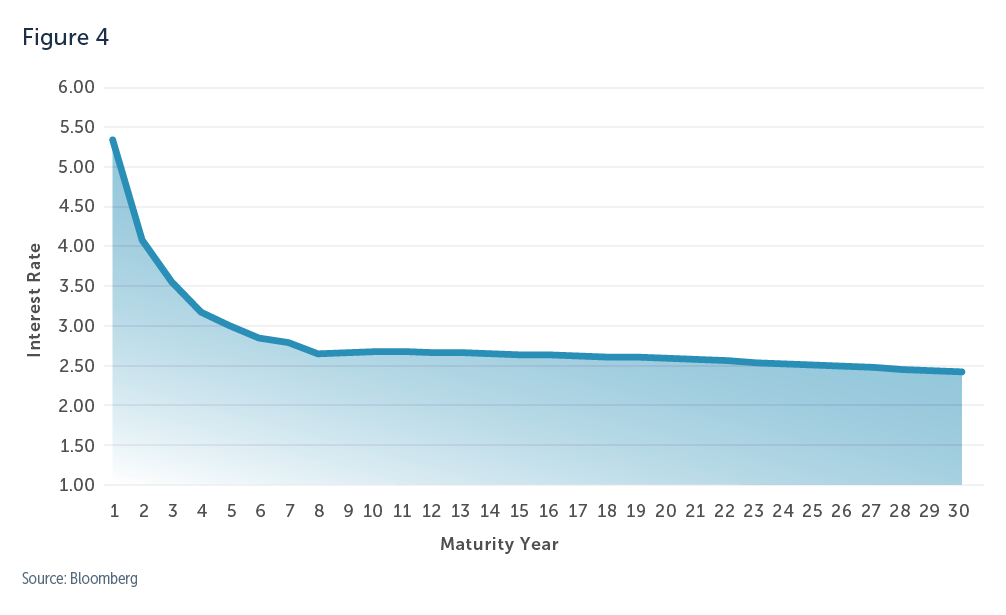

To evaluate inflation expectations, Buckingham’s Fixed Income Team looks at breakeven inflation rates, which are the difference between nominal Treasuries and Treasury Inflation Protected Securities (TIPS). Figure 4 shows the current market expectations for inflation, which is expected to remain elevated in the short term but to decline to 2.5%-2.75% over the longer term, which is much closer to the Fed’s long-run target of 2%. It’s important to note, though, that even relatively long-term inflation expectations are above the Fed’s target. One interpretation of this is that the market believes that the Fed is still willing to accept higher-than-ideal inflation levels rather than increasing rates so significantly and so quickly that it drives the economy into a moderate recession.

Should I continue to invest in fixed income when rates are expected to rise further?

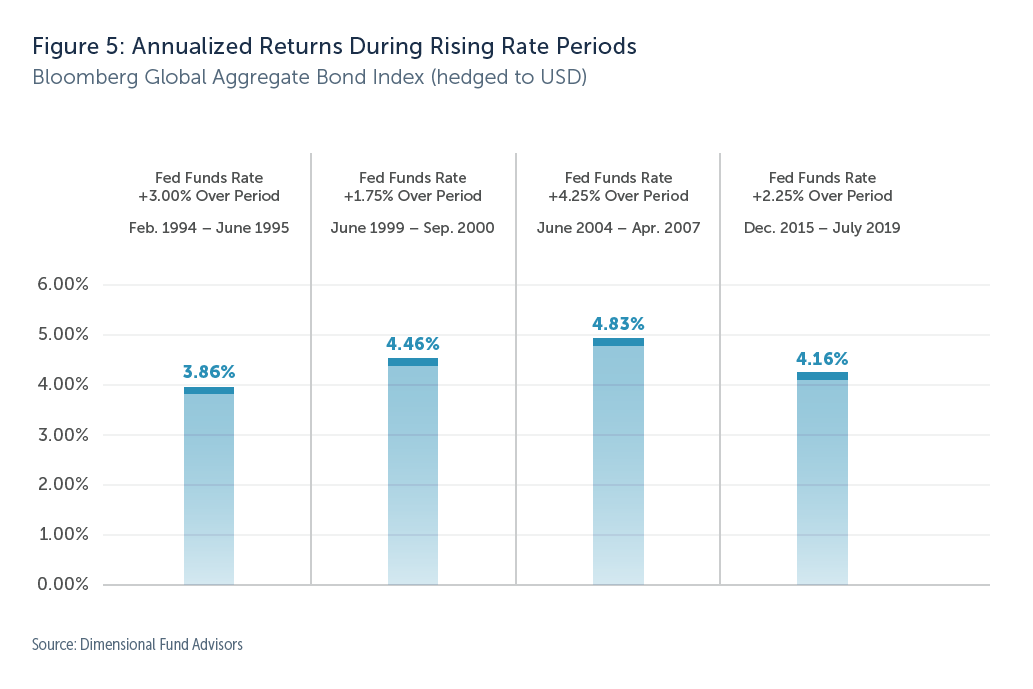

While rising rate environments can be tough when the market adjusts its rate expectations so rapidly, higher rates ultimately benefit investors in the long run. To illustrate this, Dimensional Fund Advisors examined fixed income returns during the most notable periods of Fed funds rate increases since 1990.

Figure 5 shows that in each of these four periods of rising rates, fixed income actually produced positive returns. Periods of rising interest rates don’t automatically doom investors to negative returns.

How should fixed income investors position their portfolios?

Buckingham’s Investment Policy Committee (IPC) continues to recommend clients focus their fixed income portfolios on short-to intermediate-term maturities coupled with an allocation to inflation-protected bonds, generally 20% or so. The focus on the shorter end of the yield curve has been very effective at reducing portfolio risk within a rising rate environment, while the allocation to inflation-protected bonds will hedge against unexpected inflation.