FROM OUR INVESTMENT COMMITTEE: Q1 2022 in Perspective

MODERNIST’S ASSET CLASS INVESTING PORTFOLIOS ARE STRATEGICALLY INVESTED WITH A FOCUS ON LONG-TERM PERFORMANCE OBJECTIVES. PORTFOLIO ALLOCATIONS AND INVESTMENTS ARE NOT ADJUSTED IN RESPONSE TO MARKET NEWS OR ECONOMIC EVENTS; HOWEVER, OUR INVESTMENT COMMITTEE EVALUATES AND REPORTS ON MARKET AND ECONOMIC CONDITIONS TO PROVIDE OUR INVESTORS WITH PERSPECTIVE AND TO PUT PORTFOLIO PERFORMANCE IN PROPER CONTEXT.

During the first quarter, global stock markets fell from previous all-time highs amidst a dramatic uptick in volatility, reversing the trend from the previous quarter. The Russian invasion of Ukraine and the resulting humanitarian crisis had ripple effects throughout global markets, where we saw significant spikes in oil and other commodities and supply chains stifled again as they are still recovering from previous COVID-related issues. In the U.S., the Fed continued to signal a series of rate hikes to combat rising inflation while also trying to engineer a “soft landing” for the U.S. economy that avoids a recession. These events and other factors resulted in negative performance for domestic and international stock markets during the quarter.

For the quarter, U.S. stocks (as measured by the Russell 3000 Index) lost 5.3%, and non-U.S. developed market stocks (as measured by the MSCI World Ex U.S. IMI Index) lost 5.2%. Emerging market stocks (as measured by the MSCI Emerging Markets IMI Index) lost 6.6%.

The U.S. Dollar Index, a measure of the value of the United States dollar relative to a basket of foreign currencies, increased during the quarter—the U.S. dollar increased by 2.4% compared to foreign currencies. Over the past 12 months, the U.S. dollar increased by 5.4%. The increase in the dollar is a headwind to non-U.S. investments held by U.S. investors for the last 12 months.

U.S. interest rates increased during the quarter as the Federal Reserve raised the target range of the Fed Funds rate from 0.0%-0.25% to 0.25%-0.50%. This is the first rate change since March 2020. However, markets have currently priced in the expectation of nine rate hikes during the remainder of 2022.

U.S. Economic Review

The final reading for fourth quarter annualized GDP growth of 6.9% showed continued economic expansion and a rebound from the previous quarter’s more sluggish growth. The unemployment rate continues to shrink with a reading of 3.6% to end the first quarter.

Domestic inflation showed a reading of 5.4% in February 2022 as the Fed’s preferred gauge of overall inflation, the core Personal Consumption Expenditures (PCE) index that excludes food and energy, remained well above the Fed’s long-term target average of 2.0%.

Financial Markets Review

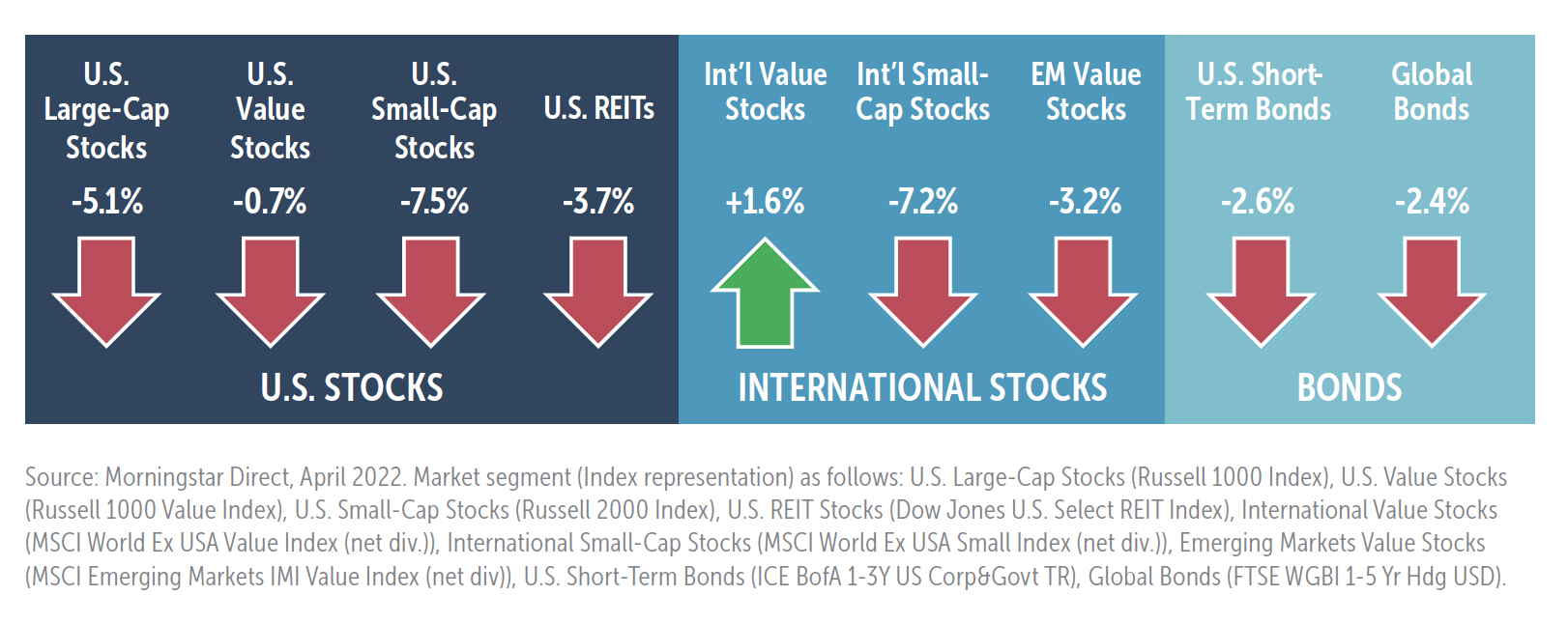

Domestically, all size and style equity categories were down during the quarter. International developed stock markets also posted negative performance—with the exception of international large-cap value stocks—and were negatively impacted during the quarter by the strengthening U.S. dollar.

International value stocks were the best performing asset class and U.S. small-cap stocks were the worst performing asset class during the quarter. The economic uncertainty caused by the Russian invasion of Ukraine, coupled with rising bond yields as a result of tight labor markets, elevated inflation, and Fed intervention caused U.S. and global bond returns to move in tandem with stocks, with each down over 2.0% for the quarter.

In developed international markets, large-cap stocks outperformed small-cap stocks in all style categories for the quarter. Value stocks outperformed growth stocks in all size categories. Among the nine style boxes, international large-cap value stocks performed the best and international mid-cap growth stocks had the lowest return during the quarter.

A diversified index mix of 60% stocks and 40% bonds would have lost 4.0% during the first quarter.

Source: Morningstar Direct April 2022. U.S. markets represented by respective Russell indexes for each category (Large: Russell 1000, Value, and Growth, Mid: Russell Mid Cap, Value, and Growth, Small: Russell 2000, Value, and Growth).

Source: Morningstar Direct April 2022. International markets represented by respective MSCI World EX USA index series (Large: MSCI World EX USA Large, Value, and Growth, Mid: MSCI World Ex USA Mid, Value, and Growth, Small: MSCI World Ex USA Small, Value, and Growth).