FROM OUR INVESTMENT COMMITTEE: Q2 2022 in Perspective

MODERNIST’S ASSET CLASS INVESTING PORTFOLIOS ARE STRATEGICALLY INVESTED WITH A FOCUS ON LONG-TERM PERFORMANCE OBJECTIVES. PORTFOLIO ALLOCATIONS AND INVESTMENTS ARE NOT ADJUSTED IN RESPONSE TO MARKET NEWS OR ECONOMIC EVENTS; HOWEVER, OUR INVESTMENT COMMITTEE EVALUATES AND REPORTS ON MARKET AND ECONOMIC CONDITIONS TO PROVIDE OUR INVESTORS WITH PERSPECTIVE AND TO PUT PORTFOLIO PERFORMANCE IN PROPER CONTEXT.

During the second quarter, global stock and bond markets continued their downward trends from the previous quarter. The S&P 500 index, a popular headline stock market index in the U.S., suffered its worst first-half calendar year performance in decades while bond markets continued their descent fueled by the expectation of continued rate hikes. Elevated inflation readings and the looming specter of recession along with other market influences resulted in negative performance for the quarter across all major asset classes.

For the quarter, U.S. stocks (as measured by the Russell 3000 Index) lost 16.7%, and non-U.S. developed market stocks (as measured by the MSCI World Ex U.S. IMI Index) lost 15.2%. Emerging market stocks (as measured by the MSCI Emerging Markets IMI Index) lost 12.1%.

The U.S. Dollar Index, a measure of the value of the United States dollar relative to a basket of foreign currencies, increased during the quarter—the U.S. dollar increased by 6.5% compared to foreign currencies. Over the past 12 months, the U.S. dollar increased by 13.3%. The increase in the dollar is a headwind to non-U.S. investments held by U.S. investors for the last 12 months.

U.S. interest rates increased during the quarter as the Federal Reserve raised the target range of the Fed Funds rate twice from 0.25%-0.50% to 0.75%-1.00% in May and then again to 1.50%-1.75% in June. The second rate hike of 0.75% was the single largest rate hike approved by the Fed since 1994. However, markets have currently priced in the expectation of seven additional rate hikes during the remainder of 2022, with an implied target range of 3.25%-3.50% by year’s end.

U.S. Economic Review

The final reading for first quarter annualized GDP growth of -1.6% showed a contraction of economic output and is the first negative reading since the first half of 2020. The unemployment rate continues to hold steady with a reading of 3.6% in May 2022. This coincides with a tight labor market that saw approximately 11.4 million job openings for 6 million unemployed workers at the end of April. Domestic inflation showed a reading of 4.7% in May 2022 as the Fed’s preferred gauge of overall inflation, the core Personal Consumption Expenditures (PCE), remained well above the Fed’s long-term target average of 2.0%. Headline inflation, as measured by the Consumer Price Index (CPI), closed out May with a reading of 8.6%. These readings tend to differ primarily because CPI includes volatile categories like food and energy in its methodology while core PCE does not.

Financial Markets Review

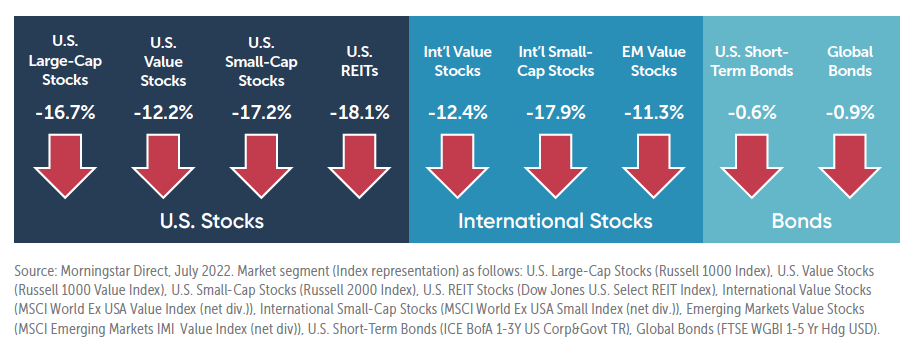

Domestically, all size and style equity categories were down during the quarter. International developed stock markets also posted negative performance, and, for U.S. investors, returns were negatively impacted during the quarter by the strengthening U.S. dollar. Emerging Markets value stocks were the best performing asset class and U.S. REITs were the worst performing asset class during the quarter. The economic uncertainty caused by the ongoing Russian invasion of Ukraine, stubbornly high inflation, and the awakening of a long-dormant hawkish Fed caused U.S. and global bonds to lose almost one percent for the quarter and move in the same direction as stocks.

In the U.S., large-cap stocks declined less than small-cap stocks in all style categories with the exception of growth stocks. Value stocks declined less than growth stocks in all size categories. Among the nine style boxes, large-cap value stocks performed the best and mid-cap growth stocks had the lowest return during the quarter.International value stocks were the best performing asset class and U.S. small-cap stocks were the worst performing asset class during the quarter. The economic uncertainty caused by the Russian invasion of Ukraine, coupled with rising bond yields as a result of tight labor markets, elevated inflation, and Fed intervention caused U.S. and global bond returns to move in tandem with stocks, with each down over 2.0% for the quarter.

Source: Morningstar Direct, July 2022. U.S. markets represented by respective Russell indexes for each category (Large: Russell 1000, Value, and Growth, Mid: Russell Mid Cap, Value, and Growth, Small: Russell 2000, Value, and Growth).

Source: Morningstar Direct, July 2022. International markets represented by respective MSCI World EX USA index series (Large: MSCI World EX USA Large, Value and Growth, Mid: MSCI World Ex USA Mid, Value, and Growth, Small: MSCI World Ex USA Small, Value, and Growth).

In developed international markets, large-cap stocks declined less than small-cap stocks in all style categories for the quarter. Like in the U.S., value stocks declined less than growth stocks in all size categories. Among the nine style boxes, international large-cap value stocks performed the best and international small-cap growth stocks had the lowest return during the quarter.

A diversified index mix of 60% stocks and 40% bonds would have lost 9.7% during the second quarter.