Silicon Valley Bank + Federal Reserve Action: What It Means For You

reminders + resources for times of uncertainty:

A helpful visual for keeping historical context top of mind!

News develops quickly; markets absorb the shock just as quickly, eventually recovering over time.

Our investment and planning mantra is always to clear the financial noise around us so we can concentrate on the things we can control.

We won’t bother summarizing the recent financial news, instead check out these links for a reminder on what’s been happening:

Listen to The Indicator from Planet Money, which explains SVB’s background story.

Read The New York Times article on what happened with SVB.

Watch the video below from our Investment Committee! 👇

KNOW THIS: history helps to tune out the noise

While we can’t know exactly what will happen next, we can use historical context to remind ourselves that the market recovers over time.

Use our Down Market Resources to help answer your questions, and enjoy some poetry about reducing anxiety while you’re there.

Then go for a walk or spend time with a loved one!

KNOW THIS: If you’re a Modernist client, you own the right kinds of bonds

We apply our evidence-driven approach to planning and investing to help navigate these uncertain times. We remain proponents of using academic evidence to support each investment decision we make in our portfolios. See more on this below!

Bottom Line: In the case of bonds, the evidence strongly supports the use of high-quality, short-to-intermediate-term bonds, as they are far less sensitive to rising interest rates. These are the conservative types of bonds we build into clients’ portfolios (the opposite of what SVB owned).

KNOW THIS:Your deposits are safe

To create stability in banking, Federal Reserve Board announced that for a short time, it will go beyond the usual $250,000 FDIC insurance, making available additional funds to help banks meet the needs of all their depositors.

Bottom Line: FDIC is covering all your money at banks and credit unions, not just the usual $250,000 per depositor.

Do This: Cash is Queen, so best treat her right

This is our cash mantra (and drag queen homage). So, take a beat to confirm that your bank deposits are FDIC insured.

You generally get $250,000 of insurance per depositor, per bank. So, if you and your partner have joint or individual bank accounts, you likely have $500,000 of insurance. If your business also has accounts, there’s another $250,000 for a total of $750,000.

Bottom Line: If you have enough FDIC insurance at your bank, leave your money where it is. Don’t exacerbate the current bank run problem!

Do This: Surf the Financial Noise

Times of uncertainty and anxiety call for us to shift our energy to what we can control. Let’s clear the noise together!

Step 1: Build a plan with a data-driven approach focused on the long-term.

If you’re a Modernist client: consider this DONE! If you’re looking for a planner to help you navigate the next news cycle, check out our Referrals & Resources page for tips on hiring a planner.

Step 2: Tune out the noise

We build portfolios around assumptions based on 20-year market cycles, not short-term data noise. Stay focused on that long-term horizon! Remember that when we take a look at the markets during volatility and review its cycles, we see a pattern that shows that sticking with it is the way to go.

Read some poetry about navigating uncertainty – scroll to the bottom of our Down-Market blog page.

Step 3: Step into generosity

Lean into your power to counteract fear by disrupting the anxious narrative (cite the points above) among coworkers, friends, family. While you are at it, go for a walk or spend time with the people you love

We have Enough, so let’s concentrate on those who are most impacted by economic uncertainty. Consider supporting your local food bank, reproductive or civil rights organizations, or any other orgs working to make our communities more equitable.

what does all this mean for Inflation and Interest Rates?

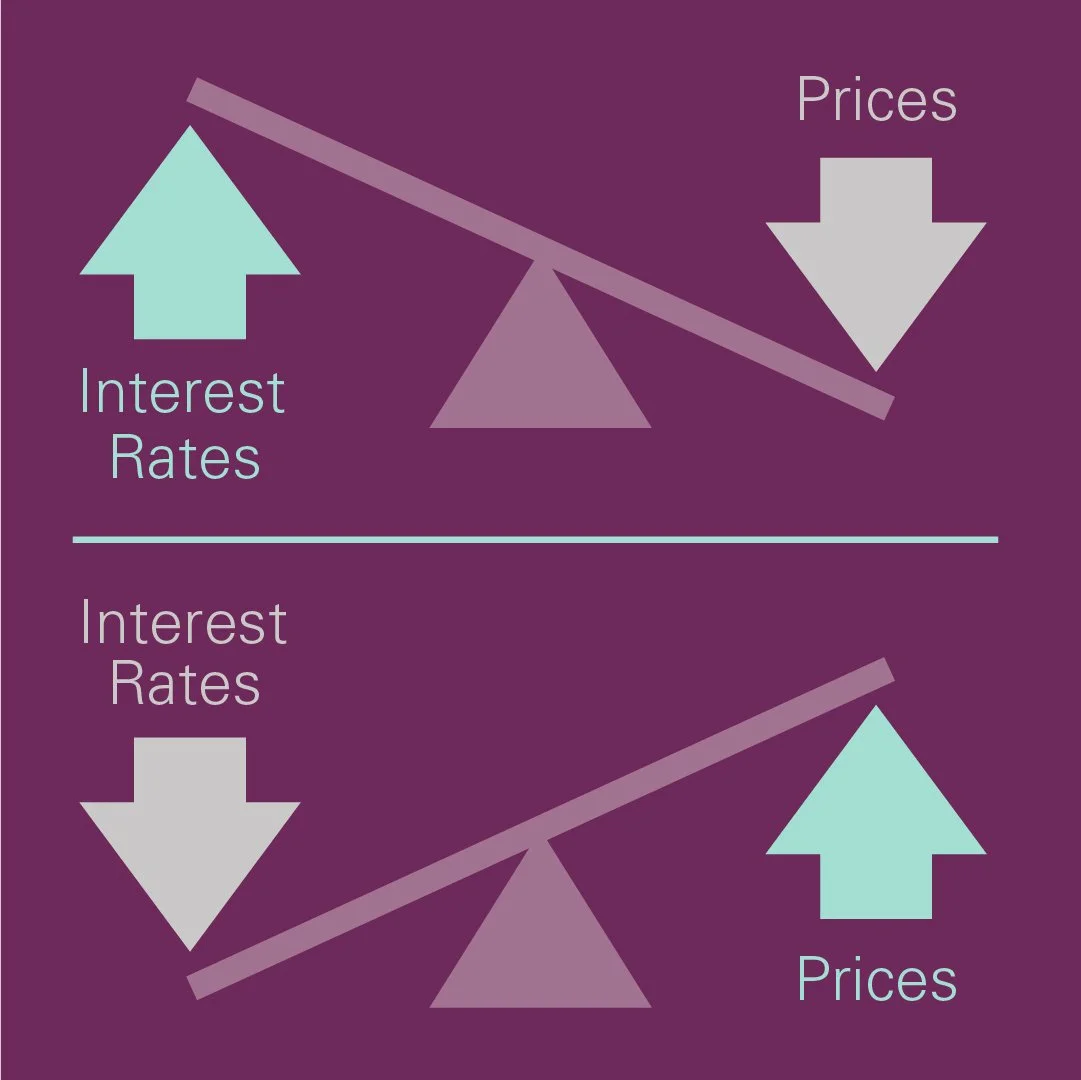

Much of the volatility seen in bonds comes from interest rate risk. As rates go up bond prices move down, and investors would rather buy freshly issued bonds paying higher coupons (interest on their investment). Interest rate risk can have a large impact on the prices of the bonds held. The longer the average maturity of the bonds held, the greater impact a change in interest rates will have. In a rising rate environment, longer-term bonds will decrease faster than short-term bonds and vice versa.

Rising inflation will affect bond prices because the value of your future coupon and maturity payments will be worth less. Short-term bonds may act as a good hedge against inflation because your bonds will be maturing quickly and principal proceeds will be returned, with the potential ability to be reinvested at higher rates.

Check out our Investment Methodology white paper to learn more about how we construct our bond (fixed income) holdings in our portfolios, as well as other scintillating topics!