Q4 Market Commentary: A Look Back & Ahead

MODERNIST’S ASSET CLASS INVESTING PORTFOLIOS ARE STRATEGICALLY INVESTED WITH A FOCUS ON LONG-TERM PERFORMANCE OBJECTIVES. PORTFOLIO ALLOCATIONS AND INVESTMENTS ARE NOT ADJUSTED IN RESPONSE TO MARKET NEWS OR ECONOMIC EVENTS; HOWEVER, OUR INVESTMENT COMMITTEE EVALUATES AND REPORTS ON MARKET AND ECONOMIC CONDITIONS TO PROVIDE OUR INVESTORS WITH PERSPECTIVE AND TO PUT PORTFOLIO PERFORMANCE IN PROPER CONTEXT.

As evidence-based investors, we use an approach fueled by data with over 50 years of research, rooted in diversification, and tax conscious investment options. Time has proven the value of investing. While these quarterly market reviews are helpful for staying informed, we also love to remind our clients and community: focus on what you can control, remember the big picture, and stick to your plan.

market snapshot

Global equity markets ended the year on a positive note, with U.S., international developed, and emerging market stocks all posting gains in Q4. On a year-to-date basis, non-U.S. equities were the top performers, with developed and emerging markets returning 32.2% and 31.4%, respectively. While U.S. equities trailed their international peers, they still delivered a strong 17.1% return for the year, led by large-cap growth stocks.

U.S. and international fixed income also generated positive returns in Q4, helping make 2025 a strong year for fixed income, supported by elevated income and a declining yield curve.

Economic Spotlight:

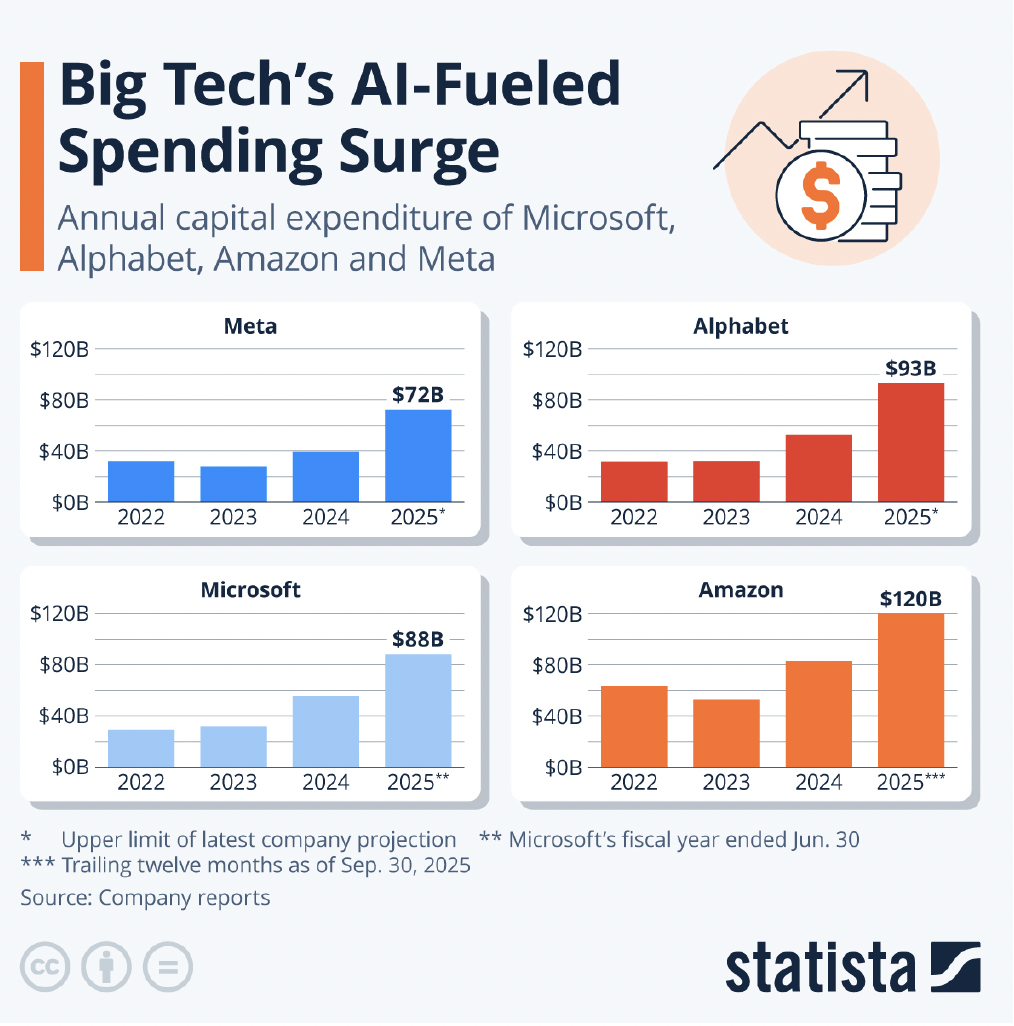

Will Big AI Spending Translate to Outsize Returns?

Source: Statista. “Tech’s AI-Fueled Spending Surge” November 20, 2025

Over the next five years, McKinsey estimates cumulative artificial intelligence investment will reach $5.2 trillion. Much of this spending is going toward building data centers and manufacturing chips and servers, making today’s technology firms look more like capital-intensive infrastructure companies than traditional software businesses.

Kai Wu of Sparkline Capital notes that firms with high capital expenditures—or those becoming more asset-heavy—often underperform peers for several reasons. Infrastructure must be matched by sufficient demand to justify capacity. Asset-heavy models are also easier for competitors to replicate, increasing pricing pressure. In addition, shifting from an asset-light to an asset-heavy model typically reduces returns on invested capital.

This shift has significant implications for large technology firms, including the Magnificent Seven, which are transitioning from asset-light software companies into infrastructure operators. This does not imply inevitable underperformance, but it does suggest a changing risk profile.

For investors, two lessons stand out. The largest spenders will not automatically be the biggest winners. In the late 1990s, many firms invested heavily in fiber infrastructure yet failed to capture most of the internet’s gains. Finally, even in AI, valuations matter.

Economic Growth Remains Strong Despite Slowing Job Market

Main Takeaway

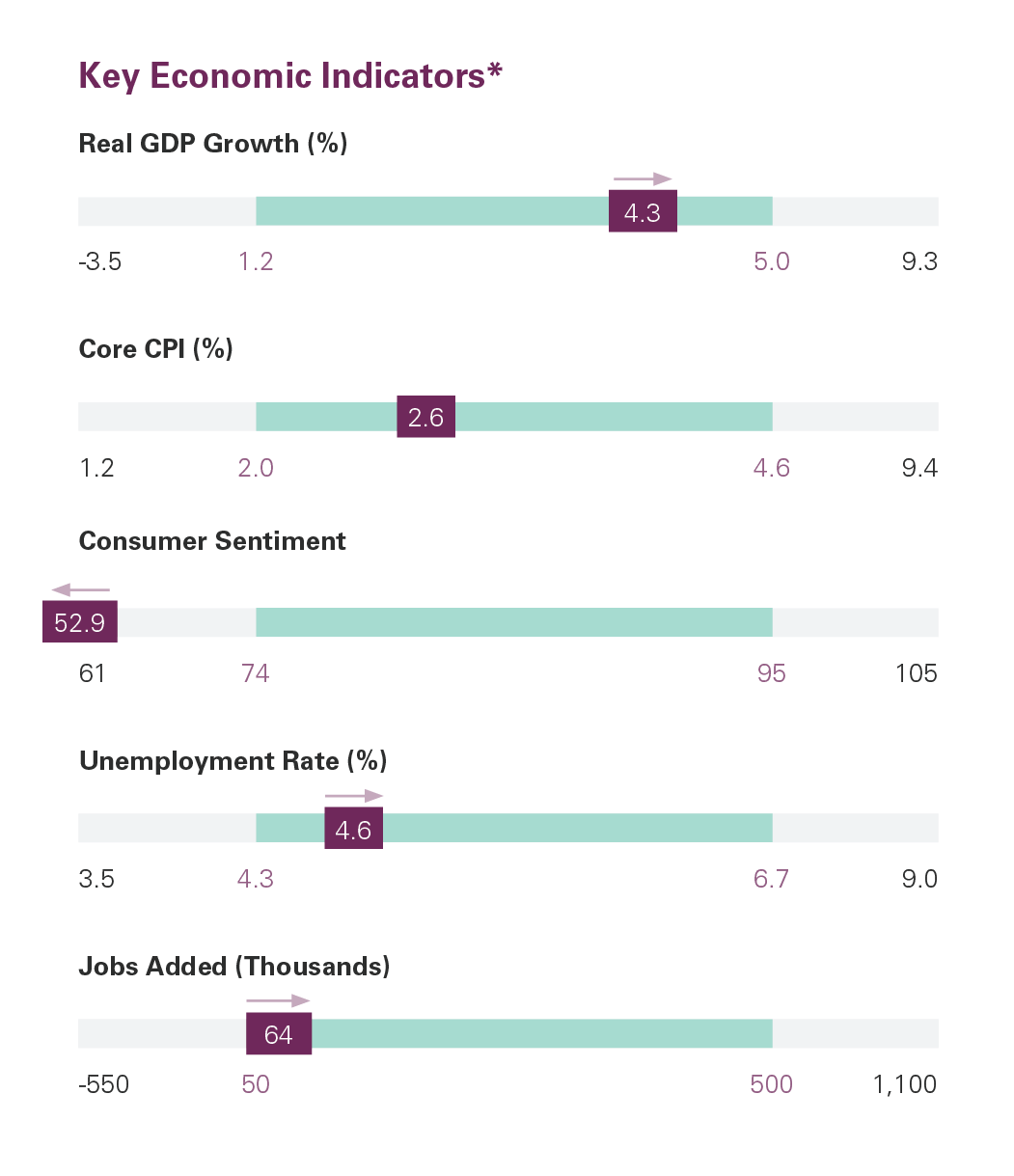

The U.S. economy showed renewed strength in Q3, expanding at a robust 4.3% annualized pace (1), exceeding expectations, supported by solid consumer spending despite weak confidence. Inflation showed signs of moderation, with November CPI cooling to 2.7% (2) from 3.0% the prior month. However, labor market conditions remain a concern, as job growth slowed and the unemployment rate rose to 4.6% (3), the highest level in four years.

Top Risks

The cooling job market continues to raise concerns, with the U.S. economy adding only 67,000 jobs over the three-month period ending in November and the unemployment rate rising to 4.6% (3). Consumer confidence has also weakened, with the Consumer Confidence Index falling to its lowest level since April4. The Expectations Index, which reflects consumers’ outlook for income, business, and labor conditions, remained well below 80, the recession threshold, for the tenth consecutive month.

Sources of Stability

The U.S. economy continues to hum along, posting a 4.3% (1) annualized growth rate in Q3. Consumer spending remains very strong, particularly amongst high income households, rising 3.5% in Q3, up from the 2.5% pace in Q2. More recent real-time indicators, including retail sales and card-swipe data suggest consumer spending continues to be robust. Despite ticking up slightly in November, unemployment remains low at 4.6% (3) and the most recent inflation data showed some moderation.

KEY ECONOMIC INDICATORS: AREAS TO WATCH

U.S. Economic Growth

U.S. economic growth remains robust, expanding at a 4.3% (1) annualized rate in Q3, thanks to a 3.5% (1) surge in consumer spending. Stripping out more volatile components such as inventories, trade, and government spending, real final sales to private domestic purchasers rose 3.0% (1), slightly above the 2.9% pace in Q2. Looking ahead, the Atlanta Fed projects Q4 GDP growth of 2.7% (2), with real final sales to private domestic purchasers moderating to 1.8%. Overall, economic growth remains solid.

Inflation Trajectory

Although inflation remains above the Federal Reserve’s 2% target, the most recent report was cooler than expected, with headline CPI rising 2.7% year over year (YoY) in November (3) (monthly data were unavailable), down from 3.0% in September. Beneath the surface, the report was generally encouraging as housing inflation, CPI’s largest component, slowed to 3.0% YoY, its smallest increase since 2021. In contrast, energy prices rose 4.2% YoY, led by a 6.9% increase in electricity costs.

Monetary Policy

As expected, the Federal Reserve lowered the federal funds rate by 25 bps at both their October and December meetings, bringing the target range to 3.50%–3.75%. The updated December dot plot (4) signaled just one additional rate cut in 2026, contrasting with the market’s expectation of two. In the press conference, Chair Jerome Powell struck a more hawkish tone, saying the decision to cut was a “close call” and emphasizing that policymakers are now well-positioned to “wait and see how the economy evolves.”

PRIVATE CREDIT

Recent headlines have understandably raised concerns about potential losses in private credit. However, data from the Cliffwater Direct Lending Index (CDLI) indicate that realized losses and non-accruals remain at or below historical averages, easing fears of deteriorating credit quality. Importantly, private credit is primarily an income-driven strategy. Even during the worst 12-month period of the financial crisis, realized losses were 9.3% (5), while income totaled 12.3% (5), resulting in a positive return spread of just over 3% (5).

Labor Market

The labor market is showing signs of stress, with the U.S. economy adding just 64,000 (1) jobs in November while unemployment rose to 4.6%, its highest in four years. Additionally, October saw a decline of 105,000 jobs and August and September were revised lower by a combined 33,000. Furthermore, the U-6 unemployment rate, which also captures those who are employed part-time for economic reasons, rose to 8.7% from 8.0%. JOLTS data reinforces the slowdown narrative with hiring declining and quits at their lowest level since 2020 (2).

Consumer spending

Consumer spending remained robust in Q3, rising 3.5% (3), up from 2.5% growth in Q2. Real-time spending indicators point to solid consumption in Q4, with the Atlanta Fed projecting consumer spending growth to be 1.6% for the quarter. Consumer incomes have continued to outpace rising living costs, with U.S. real wage growth of 0.8% (4) over the 12-month period ending in November. Regardless, consumer sentiment remains subdued, with U.S. consumer confidence falling again in December (5).

Global Economy

Economic growth was mixed across Europe in Q3, with U.K. real GDP slowing to just 0.1% (6) while the Euro Area accelerated to 0.3% (7). Asia showed a similar split with the Chinese economy picking up slightly to 1.1% (7), while Japan contracted by 0.6% (7). Looking ahead to 2026, the IMF and OECD (Organization for Economic Co-operation and Development) expect global growth to remain steady but slow at 3.1% (8) and 2.9% (9) respectively, while the World Bank is more pessimistic, forecasting growth of just 2.5% (10).

Yield Curve

Treasury yields were mixed in Q4, with the two-year yield declining 13 bps to 3.47%, the 10-year little changed, rising just 2 bps to 4.18%, and the 30-year increasing 11 bps to finish the quarter at 4.84%. The path was far from smooth: yields fell through much of October amid expectations of more accommodative monetary policy, before repricing later in the quarter as incoming economic data and updated Federal Reserve forecasts shifted market expectations.

Thanks to our reliance on long-term evidence-based investing principals, we know that short term data is too noisy to determine our investing choices. Yet, we always like to offer our review of markets because we believe this information should be accessible to all!

Investment Planning Implications

Where do markets go from here?

International Resurgence. International developed and emerging market stocks outperformed U.S. equities for the first time in more than a decade, posting gains of 30.4% and 30.0% respectively, about 13 percentage points ahead of U.S. markets. With U.S. valuations still stretched relative to international peers, non-U.S. stocks may be well positioned to outperform again in 2026.

Lagging value in the U.S. U.S. small-cap value stocks underperformed large-cap growth, particularly AI-related companies, for the third straight year in 2025 and in seven of the past 10 years. While small-cap value valuations remain near long-term averages, large-cap growth trades at roughly twice its historical valuation. That said, continued AI-driven earnings growth could allow large-cap growth to outperform in the near term.

Uncertain monetary policy. Given the economic backdrop of cooling job growth, elevated inflation, and potentially a new Fed chair in May, the future path of monetary policy is uncertain. This uncertainty is reflected in the growing dissent among both voting and non-voting FOMC members. As a result, markets are likely to experience heightened volatility around inflation and employment data in the months ahead.

What are the investment planning implications?

Tune out the forecasts. Investors naturally want to focus on forecasting the future (which is unknowable) instead of focusing on what they can control: the risk they are taking. The start of the year is the perfect time to assess your need, willingness, and ability to take risks to make sure your plan is still best suited to meeting your long-term goals.

Explore all of your options. With U.S. equity valuations elevated, geopolitical risks heightened, and monetary policy uncertain, incorporating differentiated sources of risk and return, such as alternative investments, can enhance portfolio diversification beyond traditional stocks and bonds. Strategies including private credit, reinsurance, and market-neutral approaches often exhibit lower correlations to public markets, which may help improve portfolio resilience during periods of equity and fixed income volatility.

Rebalancing is key. Strong equity market performance in 2025 has likely pushed many portfolios above their target allocations. Periodic rebalancing remains a simple yet powerful tool to manage risk, maintain strategic alignment, and systematically lock in gains from outperforming areas.

For informational and educational purposes only and should be construed as specific investment, accounting, legal or tax advice. Certain information is based on third party data and may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Indexes are unmanaged baskets of securities that are not available for direct investment by investors. Index performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Foreign securities involve additional risks, including foreign currency changes, political risks, foreign taxes, and different methods of accounting and financial reporting. Emerging markets involve additional risks, including, but not limited to, currency fluctuation, political instability, foreign taxes, and different methods of accounting and financial reporting. All investments involve risk, including the loss of principal, and cannot be guaranteed against loss by a bank, custodian, or any other financial institution.